To reach the Reports Menu:

The Reports Menu can be accessed by clicking the Reports icon on the Action Bar:

Note: In the NEW look for Skyware, the Action Bar appears slightly different but retains the Reports button.

OR

The Reports screen is divided into four sections, Room Reports, Revenue Reports, Managers Reports and Other Reports.

The Tax Detail command is in the Room Reports section.

When selected, the Tax Detail Report screen will open.

Note: You can also generate a POS Tax Detail Report from this screen, (for tax details on POS checks) by using the radial button "POS Postings" at the top of the screen instead of the "Hotel Postings" radial button which is automatically selected for you when entering this screen from the Reports Menu.

Select Report Date: Select the Date Range for the report. This range identifies the dates during which the guests were/will be in house.

From: Select the date you wish to have the reporting begin for the report. By default the date selected is today's date. To change the date selected, click within the date field. This will open a calendar where you may select month, year and day. When the day has been selected the calendar will close and the date field will be automatically updated with your selection.

To: Select the date you wish to have the reporting end for the report. By default the date selected is today's date. To change the date selected, click within the date field. This will open a calendar where you may select month, year and day. When the day has been selected the calendar will close and the date field will be automatically updated with your selection.

Building: This is a drop-down menu of available building options. By default the option -ALL- is selected. Select one or leave as -ALL-. This allows you to narrow the report focus to one particular building, if desired

Tax Posting Type: This is a drop-down menu of available Tax posting type options. By default the option -ALL- is selected. Select one or leave as -ALL-. This allows you to narrow the report focus to one particular Tax posting type, if desired.

Rate Plan: This is a drop-down menu of available Rate Plan options. By default the option -ALL- is selected. Select one or leave as -ALL-. This allows you to narrow the report focus to one particular Rate Plan type, if desired.

Exclude Groups: This box may be checked or unchecked. By default it is unchecked. This option allows you to exclude any groups from the report.

When finished, click the button Show Tax Detail.

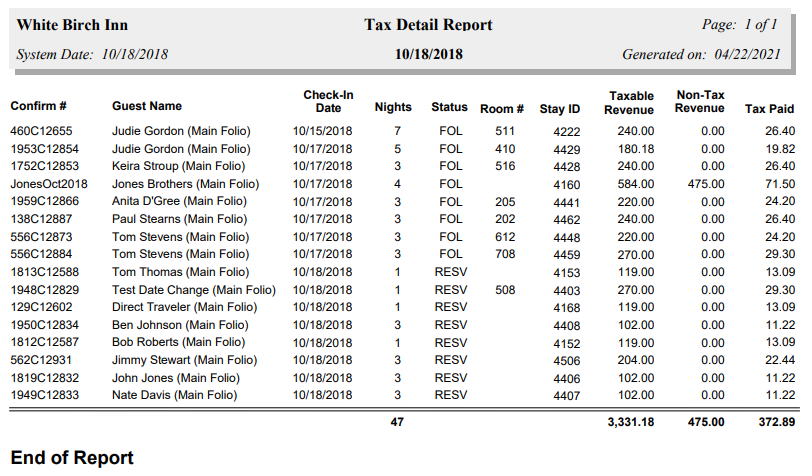

Once generated, the report lists each stay during the selected date(s), with their confirmation number, guest name, the check-in date, number of nights, current status, room number if known, and the stay ID, followed by the taxable revenue, non-taxable revenue and the tax paid. The bottom of the report shows totals for the number of room nights and totals for the taxable revenue, non-taxable revenue and tax paid.

By default, the report is generated in PDF form and opens in a separate browser window. From there you can select to save or print the report, among other options. You can, instead, check the Generate report to excel checkbox to generate the report in HTML for downloading to Excel instead of PDF. The information in this case will then be correct for importing into another document rather than immediate viewing. Or, check the Generate report to excel (data only) checkbox to export the information on the report as data only.

NOTE: The generated report appears as a pop-up window through your browser. If your browser is set to block pop-ups, you may receive a warning banner at the top of the browser. Click this banner and select to allow pop-ups so that you can view the report.